Kenya PAYE & Net Salary Calculator 2025

Calculate your take-home salary with updated rates - PAYE, NSSF (Feb 2025), SHIF, and Housing Levy

Salary & Deductions

Tax-Deductible Contributions (Optional)

These reduce your taxable income and lower your PAYE tax

Related Calculators

Explore other tools to help with your salary and tax planning

How to Use the PAYE Calculator

Follow these simple steps to calculate your income tax and net salary accurately

Enter Your Salary

Input your gross monthly salary in the Basic Salary field

Add Benefits (Optional)

Include housing allowance, car allowance, or other taxable benefits if applicable

Add Deductions (Optional)

Enter pension, mortgage interest, or medical fund contributions for tax relief

View Results

See your PAYE tax, all deductions, and net take-home salary breakdown

💡 Pro Tip: Use the Employee/Employer toggle to see the total cost to your employer including their NSSF contributions and levies.

Frequently Asked Questions (FAQ)

Everything you need to know about PAYE tax in Kenya

What is PAYE and how does it work in Kenya?▼

PAYE (Pay As You Earn) is a system of income tax collection where employers deduct tax from employees' salaries before payment. In Kenya, PAYE is managed by the Kenya Revenue Authority (KRA).

How it works:

- Tax is deducted monthly from your gross salary

- Uses progressive tax bands (higher income = higher tax rate)

- Employer remits tax to KRA by the 9th of the following month

- You receive your net salary after deductions

- Annual personal relief of KES 28,800 (KES 2,400/month) reduces your tax

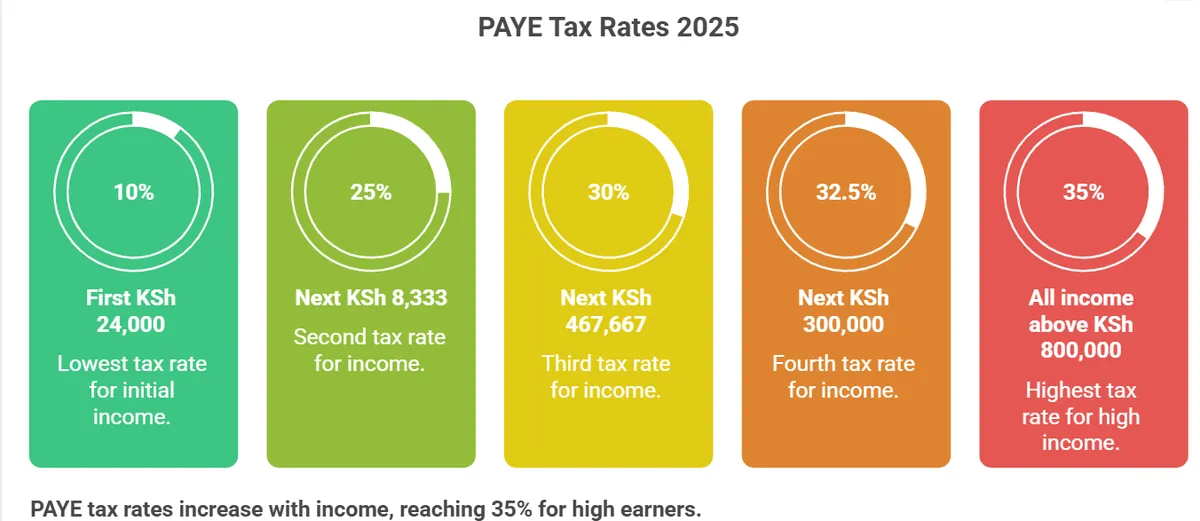

What are the current PAYE tax rates for 2025 in Kenya?▼

Kenya PAYE Tax Bands 2025:

| Monthly Taxable Income | Tax Rate | Annual Equivalent |

|---|---|---|

| Up to KES 24,000 | 10% | Up to KES 288,000 |

| KES 24,001 - 32,333 | 25% | KES 288,001 - 388,000 |

| KES 32,334 - 500,000 | 30% | KES 388,001 - 6,000,000 |

| KES 500,001 - 800,000 | 32.5% | KES 6,000,001 - 9,600,000 |

| Above KES 800,000 | 35% | Above KES 9,600,000 |

Note: Personal relief of KES 2,400/month (KES 28,800/year) is deducted from calculated tax.

What deductions are taken from my salary besides PAYE?▼

Statutory Deductions (Mandatory):

- PAYE Tax: Based on progressive tax bands (10%-35%)

- NSSF (Pension):

- Tier I: 6% of first KES 7,000 (max KES 420)

- Tier II: 6% of KES 7,001 - KES 36,000 (max KES 1,740)

- Total maximum: KES 2,160/month

- SHIF (Social Health Insurance Fund): 2.75% of gross salary (min KES 300)

- Housing Development Levy: 1.5% of gross salary

Optional Deductions:

- Pension contributions (for tax relief)

- Mortgage interest (for tax relief)

- Personal insurance premiums (15% relief, max KES 5,000/month)

- Savings and cooperative society contributions

What is personal relief and how does it reduce my PAYE tax?▼

Personal Relief is a tax reduction granted to all employed individuals in Kenya to reduce their tax burden.

Current Rate (2025):

- Monthly: KES 2,400

- Annual: KES 28,800

How it works:

- Calculate gross tax using tax bands

- Subtract KES 2,400 from the gross tax

- The result is your net PAYE tax payable

Example:

If your gross tax = KES 5,000

Personal relief = KES 2,400

Net PAYE = KES 2,600

Note: Everyone gets this relief automatically - no application needed.

How can I reduce my PAYE tax legally in Kenya?▼

Legal Ways to Reduce PAYE Tax:

1. Pension Contributions

Contribute to a registered pension scheme - contributions are allowable deductions that reduce your taxable income.

2. Mortgage Interest Relief

If you have a home loan, mortgage interest (up to KES 300,000/year) is deductible from taxable income.

3. Insurance Premium Relief

Get 15% tax relief on life insurance, education, and health insurance premiums (combined max KES 5,000/month or KES 60,000/year).

4. Medical Fund Contributions

Contributions to registered medical funds reduce your taxable income.

5. SHIF & NSSF Deductions

As of 2025, SHIF and NSSF contributions are allowable deductions that reduce your taxable income before PAYE is calculated.

Important: Always consult with a tax advisor or accountant to ensure compliance with KRA regulations.

What is the difference between gross salary, taxable income, and net salary?▼

Gross Salary

Your total salary before any deductions. This includes:

- Basic salary

- Housing allowance (if applicable)

- Transport allowance

- Other taxable benefits

Taxable Income

Gross salary minus allowable deductions:

- Gross Salary

- Minus: NSSF contributions

- Minus: SHIF contributions

- Minus: Pension contributions

- Minus: Mortgage interest

- = Taxable Income (this is what PAYE tax is calculated on)

Net Salary (Take-Home Pay)

What you actually receive after all deductions:

- Gross Salary

- Minus: PAYE Tax

- Minus: NSSF

- Minus: SHIF

- Minus: Housing Levy

- Minus: Other deductions (loans, SACCOs, etc.)

- = Net Salary (amount deposited to your bank)

Example:

Gross Salary: KES 100,000

Taxable Income: ~KES 94,000 (after NSSF & SHIF)

Net Salary: ~KES 76,000 (after all deductions)

When is PAYE tax due and who is responsible for payment?▼

Employer Responsibility:

- Deduction: Employer must deduct PAYE from employee salaries each month

- Payment Deadline: 9th of the following month

- Filing: Submit P10 form via iTax portal showing all deductions

- Annual Return: File annual return by end of February

- P9 Form: Issue P9 form to employees annually

Employee Responsibility:

- Provide accurate information (PIN, exemptions, etc.)

- Verify monthly payslip deductions

- Keep P9 forms for tax filing

- Report any discrepancies to employer or KRA

⚠️ Penalties for Late Payment:

5% of unpaid tax + 1% per month (max 100% of unpaid amount)

Possible prosecution for non-compliance

What are taxable and non-taxable benefits in Kenya?▼

✓ Taxable Benefits (Add to gross income):

- Housing allowance

- Transport/car allowance

- Airtime allowance

- Entertainment allowance

- Risk/danger allowance

- Commuter allowance

- Bonus/commission

- Overtime pay

- Director's fees

- Value of company car (20%-30%)

- Low-interest loans benefit

✗ Non-Taxable Benefits:

- Employer NSSF contributions

- Medical cover (if reasonable)

- Group life insurance

- Staff meals (if available to all)

- Uniforms/protective gear

- Training and education (job-related)

- Retirement gratuity

- Retrenchment/redundancy pay

- Death/disability benefits

- Leave pay (normal leave)

💡 Important: If you receive housing from your employer, a deemed benefit is calculated as 15% of your total cash emoluments and added to taxable income.

How do I calculate PAYE tax manually?▼

Step-by-Step PAYE Calculation:

Step 1: Calculate Gross Salary

Basic Salary + Allowances + Benefits = Gross Salary

Step 2: Calculate Allowable Deductions

NSSF (max KES 2,160) + SHIF (2.75%) + Pension + Mortgage Interest

Step 3: Calculate Taxable Income

Gross Salary - Allowable Deductions = Taxable Income

Step 4: Apply Tax Bands

• First KES 24,000 × 10% = KES 2,400

• Next KES 8,333 × 25% = KES 2,083

• Remainder × 30% (or higher bands)

Step 5: Subtract Personal Relief

Gross Tax - KES 2,400 = Net PAYE

Step 6: Calculate Net Salary

Gross Salary - (PAYE + NSSF + SHIF + Housing Levy + Other Deductions)

🎯 Pro Tip: Use our calculator above to get instant, accurate results without manual calculations!

Where can I get official information about PAYE tax in Kenya?▼

Official Resources:

Kenya Revenue Authority (KRA)

Website: www.kra.go.ke

iTax Portal: itax.kra.go.ke

Call Centre: 0711 099 999 / 0730 333 333

Laws & Regulations

- Income Tax Act (Cap 470)

- Employment Act 2007

- Social Health Insurance Act 2023

- NSSF Act 2013

Calculator updated with 2025 rates: NSSF (Feb 2025), SHIF (Oct 2024), PAYE tax bands (July 2023)

For official information, visit www.kra.go.ke