NSSF Calculator Kenya

Calculate your National Social Security Fund contributions - Hesabu mchango wako wa NSSF (February 2025 Rates)

What is NSSF? (Ni Nini NSSF?)

NSSF = National Social Security Fund - It's your retirement savings account / Ni akaunti yako ya pensheni

💰 How It Works:

- • Every month, 6% is taken from your salary

- • Your employer ALSO adds 6% (free money!)

- • This money is saved for when you retire

- • You get it back at age 50+ when you retire

📅 New Rates (Feb 2025):

- • Contributions increased from previous years

- • More savings = Bigger pension later

- • Employer matches your contribution

- • Maximum: KSh 4,320 from your salary

Calculate Your NSSF Contribution

💡 Gross salary = Total salary before any deductions (PAYE, SHIF, etc.)

Enter your salary above to calculate NSSF contributions

Important Information (Taarifa Muhimu)

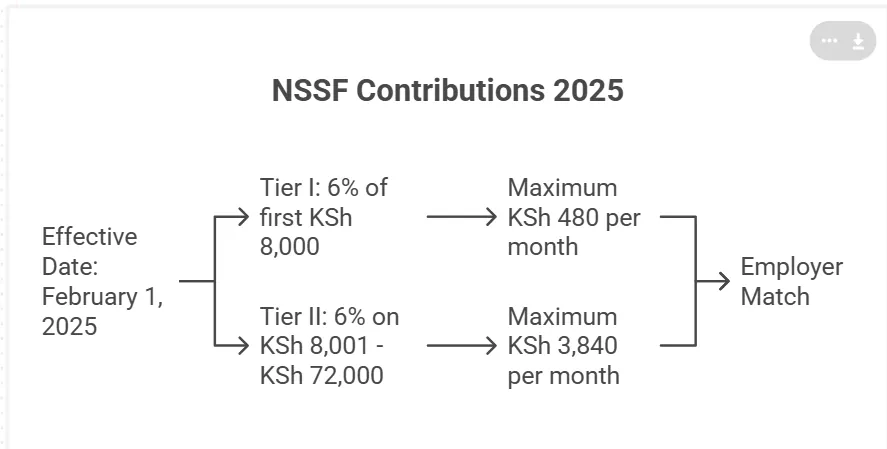

📅 New Rates Effective: February 1, 2025

Lower Limit: KSh 8,000 | Upper Limit: KSh 72,000 | Rate: 6% (employee + employer)

✅ This is Phase 3 of 5

The government is gradually increasing NSSF contributions over 5 years to improve retirement benefits for all Kenyans.

⚖️ Supreme Court Approved

On February 21, 2024, Kenya's Supreme Court upheld the NSSF Act 2013, confirming these changes are legal and will continue.

💼 Employers Must Comply

All employers must remit NSSF contributions by the 9th of each month. Failure to do so attracts penalties.

🔗 Official Resources:

- • NSSF Website: www.nssf.or.ke

- • Self Service Portal: Register online to check your balance

- • Customer Care: Call 0709 174 000 or email info@nssf.or.ke

Related Calculators

How to Manage Your NSSF Contributions

Verify Your Employer Remits

Check that your employer deducts and remits NSSF by 9th of each month. Both Tier I and II are mandatory.

Register on Self-Service Portal

Visit nssf.or.ke and register with your ID number to view statements online anytime.

Monitor Your Balance

Check your NSSF statement quarterly to verify employer contributions and track growth.

Plan for Retirement

Age 50+ and retiring? Apply for benefits online or visit nearest NSSF office with required documents.

Pro Tip: Your employer MUST match your contribution 100%. If you contribute KES 4,320, your employer also contributes KES 4,320 - that's KES 8,640 total per month building your retirement fund!

Frequently Asked Questions

What are the current NSSF rates for 2025 and how much will I pay?

NSSF rates effective February 1, 2025:

Contribution Rate: 6% from employee + 6% from employer = 12% total

Two-Tier Structure:

| Tier | Salary Range | Employee (6%) | Employer (6%) | Total |

|---|---|---|---|---|

| Tier I | First KES 8,000 | KES 480 | KES 480 | KES 960 |

| Tier II | KES 8,001 - KES 72,000 | Up to KES 3,840 | Up to KES 3,840 | Up to KES 7,680 |

| Maximum Monthly Contribution (KES 72,000+ salary) | KES 4,320 | KES 4,320 | KES 8,640 | |

Examples by Salary:

- Earning KES 30,000: You pay KES 1,800, employer adds KES 1,800 = KES 3,600 total/month

- Earning KES 50,000: You pay KES 3,000, employer adds KES 3,000 = KES 6,000 total/month

- Earning KES 100,000: You pay KES 4,320 (capped), employer adds KES 4,320 = KES 8,640 total/month

Key Change from Previous Years: Upper Earnings Limit (UEL) increased from KES 36,000 to KES 72,000, meaning higher earners now save more for retirement.

When can I withdraw my NSSF money and how much will I receive?

Eligibility for NSSF Withdrawal:

- Age Requirement: You must be at least 50 years old

- Retirement Status: You must have retired from regular employment (not working full-time anymore)

- Special Cases: Early withdrawal possible for permanent emigration, terminal illness, or total disability

Types of NSSF Benefits:

| Benefit Type | Who Qualifies | What You Get |

|---|---|---|

| Age Pension | Age 50+ and retired | All contributions + interest earned |

| Survivor's Benefit | Dependents of deceased member | Member's balance + funeral grant |

| Invalidity Pension | Permanent disability before 50 | All contributions + interest |

| Emigration Grant | Permanently leaving Kenya | All contributions + interest |

How Much Will You Receive?

Your total NSSF payout = All your contributions + All employer contributions + Investment returns (interest/dividends)

Example: If you and your employer contributed KES 6,000/month for 20 years:

- Total contributions: KES 1,440,000 (KES 6,000 × 12 months × 20 years)

- Plus investment returns (estimated 8-10% annually)

- Approximate payout: KES 2.5M - 3M+ (varies based on actual returns)

How to Claim: Register on www.nssf.or.ke or visit nearest NSSF office with ID, birth certificate, and retirement/termination letter.

Why did my NSSF deduction increase suddenly in 2025?

The NSSF Act 2013 is being implemented in 5 phases to gradually increase contributions:

| Phase | Date | Upper Limit | Max Employee Contribution |

|---|---|---|---|

| Phase 1 | Feb 2023 | KES 18,000 | KES 1,080 |

| Phase 2 | Feb 2024 | KES 36,000 | KES 2,160 |

| Phase 3 (Current) | Feb 2025 | KES 72,000 | KES 4,320 |

| Phase 4 | Feb 2026 | KES 90,000 | KES 5,400 |

| Phase 5 (Final) | Feb 2027 | KES 108,000 | KES 6,480 |

Why the Increase?

- Better Retirement Benefits: Higher contributions = bigger pension when you retire

- Inflation Adjustment: Old rates (KES 400/month max) were set in 2001 and hadn't changed for 22 years

- Legal Requirement: Supreme Court upheld NSSF Act 2013 on Feb 21, 2024 - all employers MUST comply

- Matching Contributions: Your employer ALSO pays the same amount (doubled savings!)

Who is Affected Most?

- If you earn KES 36,000 or less: No change from 2024

- If you earn KES 36,001 - KES 72,000: Your deduction increased significantly in Feb 2025

- If you earn KES 72,000+: Your deduction is capped at KES 4,320/month

Important: While your take-home pay decreased, your retirement savings DOUBLED (your employer matches your contribution). In 20 years, this could mean an extra KES 1-2M+ in your pension fund.

Can I opt out of NSSF or choose a different pension scheme?

Tier I (First KES 8,000 of salary): MANDATORY - You CANNOT opt out

All employed Kenyans earning KES 8,000+ must contribute to NSSF Tier I. This is required by law under NSSF Act 2013.

Tier II (KES 8,001 - KES 72,000): You CAN redirect to an alternative pension scheme

You may opt out of Tier II ONLY if you join an alternative pension scheme approved by the Retirement Benefits Authority (RBA).

How to Opt Out of Tier II:

- Join an RBA-approved pension scheme (e.g., company pension, SACCO pension, individual pension plan)

- Inform your employer in writing

- Employer will redirect Tier II contributions to your chosen scheme

- Tier I (KES 480) MUST still go to NSSF

Alternative Pension Schemes (RBA-Approved):

| Scheme Type | Examples | Who Can Join |

|---|---|---|

| Occupational Schemes | Company pension plans | Employees of participating companies |

| Individual Schemes | Britam, ICEA, Old Mutual PPP | Anyone (self-employed, employees) |

| SACCO Schemes | Mwalimu SACCO, Stima SACCO | SACCO members |

| Umbrella Schemes | Enwealth, Octagon | SMEs and individuals |

Should You Opt Out?

Advantages of Alternative Schemes:

- Potentially higher investment returns (10-15% vs NSSF's 8-10%)

- More investment options (stocks, bonds, real estate)

- Earlier access (some allow withdrawal from age 50, others at 55)

- Tax relief same as NSSF (30% of contributions up to KES 240K/year)

Advantages of Staying with NSSF:

- Government-backed security

- Automatic enrollment (no extra paperwork)

- Lower management fees

- Universal portability (works across all employers)

Important: You CANNOT just opt out without joining an alternative. You must prove to your employer that you're contributing to an RBA-approved scheme. Contact Retirement Benefits Authority: www.rba.go.ke | 0709 668 000

How do I check my NSSF balance and statement online?

NSSF offers 3 ways to check your balance:

1. Online Self-Service Portal (Recommended)

Step-by-Step Guide:

- Visit www.nssf.or.ke

- Click on "Self Service Portal" or "Member Login"

- If first time: Click "Register"

- Enter your National ID number

- Enter your NSSF Member Number (if you have it)

- Enter your phone number and email

- Create a password

- Verify via SMS/email

- Login with your credentials

- View your statement showing:

- Total balance

- Monthly contributions (yours + employer's)

- Interest earned

- Contribution history

- Download PDF statement for your records

2. USSD Code (Quick Balance Check)

- Dial *477# from your registered phone number

- Follow the prompts to register or check balance

- Receive SMS with your current NSSF balance

3. Visit NSSF Office or Call Customer Care

- Phone: Call 0709 174 000 (Mon-Fri 8AM-5PM)

- Email: info@nssf.or.ke

- Walk-in: Visit any NSSF office nationwide with your ID

What You'll See in Your Statement:

| Column | What It Means |

|---|---|

| Member Contribution | Your 6% deduction from salary |

| Employer Contribution | Your employer's matching 6% |

| Interest/Investment Income | Returns earned on your savings (8-10% annually) |

| Total Balance | All contributions + interest accumulated |

Pro Tip: Check your statement every 3 months to ensure your employer is remitting both your and their contributions. If you see missing months, report to NSSF immediately via 0709 174 000.

What happens if my employer doesn't remit my NSSF contributions?

Your employer is LEGALLY REQUIRED to remit NSSF contributions by the 9th of every month. Failure to do so is a criminal offense.

Employer's Legal Obligations:

- Deduct 6% from your salary (Tier I + Tier II)

- Add matching 6% from company funds

- Remit TOTAL 12% to NSSF by 9th of following month

- Provide you with payslip showing NSSF deduction

- Submit employer returns to NSSF monthly

Penalties for Non-Compliance:

| Violation | Penalty |

|---|---|

| Late remittance | 2% interest per month on unpaid amount |

| Failure to deduct | KES 50,000 fine or 1 year imprisonment |

| Deducting but not remitting | KES 100,000 fine or 2 years imprisonment |

| Repeated violations | Business closure + director prosecution |

How to Verify Employer is Remitting:

- Check your payslip - should show NSSF deduction clearly

- Login to NSSF Self-Service Portal (www.nssf.or.ke)

- View your monthly statement - contributions should appear within 2-3 weeks after deduction

- If missing, check for 2 months (sometimes delayed posting)

What to Do If Employer is Not Remitting:

- Step 1 - Approach Employer First:

- Ask HR/Accounts department politely about missing contributions

- Sometimes it's just delayed posting

- Request written confirmation of payment

- Step 2 - Report to NSSF:

- Call: 0709 174 000

- Email: info@nssf.or.ke

- Visit: Nearest NSSF office with payslips as proof

- NSSF will investigate and demand payment from employer

- Step 3 - Report to Ministry of Labour:

- If employer still refuses after NSSF intervention

- Ministry can prosecute and force compliance

Important: You are NOT responsible for paying missed contributions - your employer MUST pay both your portion and their portion, plus penalties. Your statement will be updated once employer pays, and your retirement benefits won't be affected (the debt follows the employer, not you).

Your Rights: Under Employment Act 2007, you can report wage-related violations anonymously. NSSF treats all complaints confidentially to protect employees from retaliation.

Where can I get official NSSF information and support?

Official NSSF Contact Channels:

1. NSSF Official Website

- Website: www.nssf.or.ke

- Access Self-Service Portal

- Download forms and guides

- Read latest news and updates

- Check current contribution rates

2. Customer Care Hotline

- Phone: 0709 174 000 / 0709 174 001

- Working Hours: Monday - Friday, 8:00 AM - 5:00 PM

- Email: info@nssf.or.ke

- Social Media: Twitter @nssfkenya | Facebook: NSSF Kenya

3. NSSF Offices Nationwide

Head Office: Block A, Social Security House, Bishop Road, Off Ngong Road, Nairobi

Regional Offices:

- Nairobi: Social Security House, Bishop Road

- Mombasa: Ambalal House, Nkrumah Road

- Kisumu: Social Security House, Ang'awa Avenue

- Nakuru: Westside Mall, 3rd Floor

- Eldoret: Social Security House, Uganda Road

- Nyeri: Kimathi Way

- Thika: Commercial Street

- And other satellite offices in major towns

4. Online Services & Resources

- Self-Service Portal: Register, view statements, update details

- USSD Service: Dial *477# for quick balance inquiry

- Mobile App: Download "My NSSF" on Google Play / App Store

- Email Alerts: Subscribe for monthly contribution alerts

5. Related Government Bodies

| Organization | Role | Contact |

|---|---|---|

| Retirement Benefits Authority (RBA) | Regulates pension schemes | www.rba.go.ke | 0709 668 000 |

| Ministry of Labour | Enforces employment laws | www.labour.go.ke | 0709 891 000 |

| National Treasury | Policy and oversight | www.treasury.go.ke |

Common Services Available:

- Member registration and updates

- Statement requests

- Benefits claims processing

- Employer compliance verification

- Missing contributions investigation

- Pension advice and counseling

- General inquiries

24/7 Access: While offices have working hours, the Self-Service Portal and USSD *477# are available 24/7. Register once and check your balance anytime from your phone or computer!

Calculator based on NSSF Act 2013 rates effective February 1, 2025

For official information, visit www.nssf.or.ke