Import Duty Calculator Kenya 2025

Calculate the total cost of importing a car to Kenya including customs duty, excise duty, VAT, IDF, and RDL - Updated October 2025 with official KRA rates

What is CIF?

CIF = Cost + Insurance + Freight. This is the total landed cost of your vehicle including the purchase price, shipping charges, and insurance. This value is used as the base for calculating import taxes.

Vehicle Details

Related Tax Calculators

Explore other Kenya tax and customs calculators

How to Import a Car to Kenya

Calculate CIF Value

Add vehicle cost + shipping + insurance to get CIF (landed cost)

Enter Vehicle Details

Input engine capacity (cc), age, KEBS location, and destination

View Cost Breakdown

See all taxes, duties, fees, and total import cost

Plan Your Budget

Use the total cost to budget for your car import

💡 Pro Tip: Vehicles 8 years or older cannot be imported. For 2025, only vehicles from 2017 or newer are allowed. Always verify age before purchasing.

How to Import a Car to Kenya - Video Guide

Watch this comprehensive guide on importing cars to Kenya, including all requirements and procedures

Frequently Asked Questions About Car Import to Kenya

What is the import duty rate for cars in Kenya?▼

Import duty on motor vehicles in Kenya is 35% of the CIF value (Cost, Insurance, and Freight).

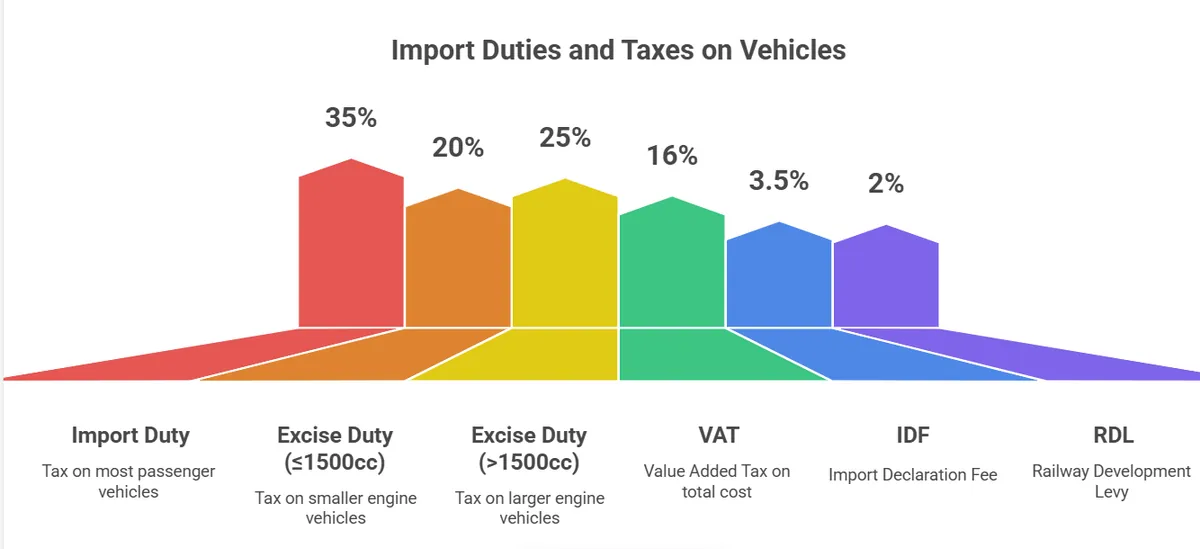

Complete Tax Breakdown:

| Tax/Duty | Rate | Applied On |

|---|---|---|

| Import Duty | 35% | CIF Value |

| Excise Duty | 20% (≤1500cc) or 25% (>1500cc) | CIF + Import Duty |

| VAT | 16% | CIF + Import + Excise |

| IDF (Import Declaration Fee) | 3.5% | CIF Value |

| RDL (Railway Development Levy) | 2% | CIF Value |

What is CIF value and how do I calculate it?▼

CIF stands for Cost, Insurance, and Freight. It's the total landed value of your vehicle at the port of entry.

CIF Calculation Formula:

CIF = Purchase Price + Shipping Cost + Insurance Cost

Example:

- Vehicle purchase price: USD 10,000 = KES 1,300,000

- Shipping (ocean freight): USD 1,200 = KES 156,000

- Insurance (1-2% of value): USD 120 = KES 15,600

- Total CIF = KES 1,471,600

Important Notes:

- Always convert foreign currency to KES using current exchange rates

- KRA uses the prevailing Central Bank of Kenya (CBK) exchange rate

- CIF value is the base for calculating all import taxes

- Shipping agent provides CIF breakdown in shipping documents

Check exchange rates: Central Bank of Kenya

What is the vehicle age limit for importing to Kenya?▼

Vehicle Age Limit: Maximum 8 years from the year of first registration.

How to Calculate Vehicle Age:

Formula: Current Year - Year of First Registration

Example for 2025:

- Vehicle first registered in 2017: Age = 2025 - 2017 = 8 years ✅ ALLOWED

- Vehicle first registered in 2016: Age = 2025 - 2016 = 9 years ❌ NOT ALLOWED

- For 2025: Only vehicles from 2017 or newer can be imported

⚠️ Important Points:

- Age is calculated from first registration date, not manufacturing date

- Check the logbook/registration document for accurate date

- Vehicles older than 8 years will be rejected at customs

- No exceptions for classic, vintage, or special vehicles

Source: KRA Customs Regulations 2025

What is KEBS inspection and is it mandatory?▼

KEBS (Kenya Bureau of Standards) Pre-Export Verification of Conformity (PVoC) is a mandatory inspection for all imported vehicles.

Inspection Options & Costs:

| Location | Cost | Timeline |

|---|---|---|

| Inspection Abroad (Origin Country) | KES 15,000 | Before shipping (recommended) |

| Inspection in Kenya (Mombasa) | KES 25,000 | After arrival (more expensive) |

What KEBS Inspects:

- Vehicle age verification (logbook check)

- Right-Hand Drive (RHD) confirmation

- Euro 4 emission standards compliance

- Safety features (airbags, seat belts, lights)

- Vehicle identification number (VIN) authenticity

- Overall roadworthiness

💡 Recommendation: Do KEBS inspection abroad (cheaper at KES 15,000) before shipping to avoid rejection upon arrival in Kenya.

KEBS Information: www.kebs.org

What documents are required to import a car to Kenya?▼

Required Documents for Car Import:

Essential Documents:

- Original logbook/registration certificate from country of origin

- Bill of Lading (shipping document)

- Commercial Invoice (purchase receipt)

- Insurance certificate

- KEBS Certificate of Conformity

- Valid passport copy (importer)

- KRA PIN certificate

Additional Documents:

- Import Declaration Form (IDF)

- Bill of Entry (customs clearance)

- Customs entry form

- Tax Compliance Certificate (if business)

- Shipping/freight receipt

- Export certificate (country of origin)

Document Processing Steps:

- Submit all documents to clearing agent at port

- Agent lodges Import Declaration Form (IDF) via KRA Simba system

- KRA assesses and generates tax bill

- Pay all duties and taxes via iTax or bank

- Collect Bill of Entry and customs release order

- Clear vehicle from port

Source: KRA Customs Clearance Procedures

Can I import a Left-Hand Drive (LHD) vehicle to Kenya?▼

NO - Left-Hand Drive (LHD) vehicles cannot be imported for private use in Kenya.

Kenya's Vehicle Requirements:

- Right-Hand Drive (RHD) ONLY: All private vehicles must have the steering wheel on the right side

- Road Safety: Kenya drives on the left side of the road, requiring RHD vehicles

- No Exceptions: Private individuals cannot import LHD vehicles

Limited Exceptions for LHD (Very Restricted):

- Diplomatic missions and international organizations (with special permits)

- Military and government agencies

- Heavy commercial vehicles (trucks, trailers, construction equipment)

- Tourist vehicles (temporary permits, must re-export)

⚠️ Warning: Attempting to import LHD vehicle for private use will result in rejection at customs and loss of shipping costs. Always verify RHD before purchase.

Source: NTSA Vehicle Import Regulations

What are Euro 4 emission standards for imported cars?▼

Euro 4 is an emission standard that limits the amount of pollutants a vehicle can emit. All imported vehicles to Kenya must meet Euro 4 standards or higher.

Euro 4 Emission Limits:

| Pollutant | Petrol (g/km) | Diesel (g/km) |

|---|---|---|

| Carbon Monoxide (CO) | 1.0 | 0.5 |

| Nitrogen Oxides (NOx) | 0.08 | 0.25 |

| Particulate Matter (PM) | - | 0.025 |

How to Check Euro 4 Compliance:

- Check vehicle's Certificate of Conformity (COC)

- Look for Euro 4 label on vehicle or documentation

- Most vehicles manufactured after 2006 (Europe) meet Euro 4

- Japanese vehicles: Check emissions label or dealer certificate

- KEBS inspection verifies Euro 4 compliance

Note: Euro 5 and Euro 6 standards are even stricter and also acceptable for Kenya import. Many modern vehicles (2010+) meet these higher standards.

Emission Standards: National Environment Management Authority (NEMA)

How long does car import clearance take in Kenya?▼

Typical Timeline for Car Import Clearance:

| Stage | Duration |

|---|---|

| Ocean Shipping (Japan/Europe to Mombasa) | 30-45 days |

| Port Arrival & Offloading | 1-2 days |

| Document Processing & Tax Assessment | 2-3 days |

| Payment of Duties & Taxes | 1 day |

| Customs Clearance & Release | 1-2 days |

| KEBS Inspection (if done in Kenya) | 2-3 days |

| NTSA Registration | 3-5 days |

| Total (With KEBS Abroad) | 40-58 days |

Factors That Can Delay Clearance:

- Missing or incorrect documentation

- KEBS inspection failures (wrong age, LHD, emission issues)

- Delays in payment of taxes

- Port congestion during peak seasons

- KRA physical inspection (random checks)

- Outstanding tax compliance issues

💡 Pro Tip: Use experienced clearing agents who know KRA procedures. They can expedite clearance to 5-7 days after port arrival.

What is IDF and RDL in car import costs?▼

IDF - Import Declaration Fee

- Rate: 3.5% of CIF value (previously 2.25%, increased July 2023)

- Purpose: Administrative fee for processing import declarations

- Collected by: Kenya Revenue Authority (KRA)

- Calculation: IDF = CIF × 0.035

- Example: CIF of KES 1,500,000 = IDF of KES 52,500

RDL - Railway Development Levy

- Rate: 2% of CIF value (previously 1.5%, increased July 2021)

- Purpose: Funding for Standard Gauge Railway (SGR) and rail infrastructure

- Collected by: Kenya Revenue Authority (KRA)

- Calculation: RDL = CIF × 0.02

- Example: CIF of KES 1,500,000 = RDL of KES 30,000

Quick Calculation Summary:

For CIF = KES 1,500,000:

- IDF (3.5%) = KES 52,500

- RDL (2%) = KES 30,000

- Combined IDF + RDL = KES 82,500

Note: IDF and RDL are mandatory fees on all imports to Kenya, not just vehicles. They're applied to the CIF value before calculating other taxes.

Where can I get official car import information and support?▼

Official Government Resources:

- 🌐Kenya Revenue Authority (KRA): www.kra.go.ke

Customs duties, tax rates, import procedures

- 🚗NTSA (National Transport & Safety Authority): www.ntsa.go.ke

Vehicle registration, number plates, inspection

- ✓KEBS (Kenya Bureau of Standards): www.kebs.org

Pre-shipment inspection, quality standards

- 📱KRA Customs Call Centre: 0711 099 999 / 0711 099 100

Monday - Friday: 8:00 AM - 5:00 PM

- ✉️Email Support: callcentre@kra.go.ke

Customs and import queries

- 💻KRA iTax Portal: itax.kra.go.ke

Pay import taxes, check duty rates

💡 Tip: Visit KRA Customs Service Centre at Mombasa Port or Times Tower (Nairobi) for in-person assistance with vehicle import procedures.

Calculator updated for 2025 with current KRA rates (July 2025 CRSP)

For official rates, visit www.kra.go.ke